Geopolitical Risks Impact on Oil Price Volatility

Geopolitical Risks Impact on Oil Price Volatility

Oil prices swing wildly when global events shake things up. Here's what you need to know:

- Geopolitical risks = world events that mess with oil supply or demand

- Examples: wars, political chaos, trade disputes

- These events can cause huge price swings in oil markets

Key impacts:

- Supply interruptions

- Demand shifts

- Market speculation

- Investor reactions

- Long-term industry investments

Past examples:

- 1973 Arab Oil Embargo: 400% price hike

- 1979 Iranian Revolution: Oil prices doubled

- 2022 Russia-Ukraine war: 52-56% price jump

How to manage:

- Diversify investments

- Use hedging methods

- Plan for different scenarios

- Stay informed on world news

- Use real-time data tools

Bottom line: Geopolitical risks keep oil prices on a rollercoaster. Stay flexible and informed to ride out the storms.

| Risk Type | Impact | Example |

|---|---|---|

| Wars | Sharp price spikes | Russia-Ukraine conflict |

| Political unrest | Supply disruptions | Venezuela crisis |

| Trade disputes | Demand shifts | US-China trade war |

| Natural disasters | Temporary price hikes | Gulf hurricanes |

Related video from YouTube

Types of geopolitical risks affecting oil prices

Geopolitical risks can send oil prices on a wild ride. Here are the main culprits:

Political unrest in oil-producing countries

When major oil producers face turmoil, prices go haywire. Look at Venezuela:

Oil production nosedived from 2.4 million barrels per day in 2015 to a mere 700,000 in 2019. The result? A tighter global oil supply that pushed prices up.

Wars and tensions between countries

Conflicts near oil hotspots spell trouble. The Russia-Ukraine war shows this clearly:

- WTI crude oil prices jumped $37.14 (52.33%)

- Brent crude oil prices shot up $41.49 (56.33%)

This conflict alone drove over 70% of oil price swings in early 2022.

Trade fights and sanctions

Trade wars and sanctions disrupt oil flow. The US-China trade war under Trump is a prime example:

As China's production slowed, its oil demand dropped. Oil prices went on a wild ride as a result.

Terrorism and cyber attacks

Oil facilities are juicy targets. Even the threat of an attack can spook markets:

In 2011, Iran threatened to block the Strait of Hormuz. They didn't follow through, but oil markets still panicked.

Natural disasters in oil-producing areas

Nature can throw a wrench in oil production. Gulf of Mexico hurricanes often shut down offshore rigs, causing supply hiccups and price jumps.

| Risk Type | Impact on Oil Prices | Real-World Example |

|---|---|---|

| Political Unrest | Supply disruptions, price spikes | Venezuela's crisis (2015-2019) |

| Wars/Conflicts | Sharp price increases | Russia-Ukraine war (2022) |

| Trade Wars/Sanctions | Demand shifts, price volatility | US-China trade war (Trump era) |

| Terrorism/Cyber Attacks | Supply fears, price uncertainty | Iran's Strait of Hormuz threat (2011) |

| Natural Disasters | Production halts, temporary price hikes | Gulf of Mexico hurricanes |

In short: Geopolitical risks are oil price wildcards. They're unpredictable but pack a serious punch.

How geopolitical risks cause oil price changes

Geopolitical risks shake up oil prices in several ways:

Supply interruptions

Political events can suddenly cut off oil supplies. For example:

"Historically when there's been an oil supply disruption in the Middle East, Saudi Arabia and the United Arab Emirates, which have combined spare capacity of more than 4 million barrels, have offset about 80% of lost supply within two quarters." - Goldman Sachs Research

But this offset isn't instant. The delay often leads to price spikes.

Demand shifts

Global tensions can change oil demand patterns. Trade wars slow production, reducing oil needs. Sanctions limit oil purchases from certain countries.

During the US-China trade war under Trump, Chinese production slowed. This dropped their oil demand, causing price swings.

Market speculation

Traders bet on future prices based on world events. Even threats can move markets. In 2011, Iran's threat to block the Strait of Hormuz spooked oil markets. The Russia-Ukraine war in 2022 sent WTI crude prices up 52.33%.

Investor reactions

Geopolitical tensions make investors nervous. They might pull money out of oil stocks or invest more in "safe" commodities like gold. These moves can amplify price changes.

Long-term oil industry investments

Ongoing global uncertainties affect big oil projects. Companies might delay new drilling. Investors could be wary of funding risky areas. This can lead to future supply issues and price volatility.

| Geopolitical Risk | Short-term Impact | Long-term Impact |

|---|---|---|

| Supply Disruption | Sharp price spike | Gradual stabilization as other producers increase output |

| Trade War | Demand drop, price fall | Potential long-term shift in oil trade patterns |

| Regional Conflict | Price uncertainty | Possible long-term supply constraints in affected areas |

| Sanctions | Immediate price jump | Restructuring of global oil supply chains |

Understanding these impacts is key for predicting oil price movements. Tools like OilpriceAPI can help track real-time price changes, allowing for quick analysis of geopolitical effects on oil markets.

Past examples of world events affecting oil prices

Oil prices and global events go hand in hand. Let's look at some key moments that rocked the oil markets:

1973-1974 Arab Oil Embargo

The first worldwide oil crisis hit hard:

- Oil prices shot up from $2.90 to $11.65 per barrel

- In today's money, that's a jump from $14 to $80 per barrel

- Total price hike: 400%

"The 1973 oil embargo shook the global energy market." - Daniel Yergin, Vice Chairman of S&P Global

1979 Iranian Revolution

Round two of oil chaos:

- Oil prices doubled to $39 per barrel

- Iran cut all oil exports for months

- Gas prices tripled, causing panic at the pumps

1990-1991 Gulf War

The "mini oil-shock" hit:

- Oil averaged $21.73 per barrel

- The UN and US stepped in to steady prices

- Supply chain hiccups led to market jitters

2003 Iraq War

Oil markets felt the heat:

- Military action messed with oil production

- Price stability became a global headache

- Long-term effects lingered in the region

Recent events

Today's world still keeps oil prices on their toes:

| Event | Impact |

|---|---|

| US-Iran tensions | Prices yo-yo on supply worries |

| Venezuela crisis | Less oil globally, prices feel it |

| Russia-Saudi Arabia oil price war (2020) | Oil prices took a nosedive |

| Russia-EU gas dispute (2022-2023) | Energy markets on a rollercoaster |

These examples show how oil prices dance to the tune of world events. For oil market watchers, tools like OilpriceAPI can help track price changes in real-time, making it easier to spot how global drama affects your wallet at the pump.

sbb-itb-a92d0a3

Ways to measure geopolitical risk in oil markets

Measuring geopolitical risk in oil markets isn't easy. But there are a few key methods that investors and analysts use:

Geopolitical risk indexes

The Geopolitical Risk (GPR) Index is a big one. It counts newspaper articles about geopolitical tensions. When big events happen (like world wars), the index shoots up.

The index comes in two flavors:

- Recent GPR Index: Uses 10 newspapers, starts from 1985

- Historical Index: Uses 3 newspapers, goes back to 1900

It also covers 44 countries with specific indexes.

News analysis

Analysts keep an eye on the news to get a feel for market risk. The GPR index, for example, counts articles in eight categories:

- War Threats

- Peace Threats

- Military Buildups

- Nuclear Threats

- Terror Threats

- Beginning of War

- Escalation of War

- Terror Acts

Expert opinions

Industry experts weigh in on potential risks. Their views can shape how the market sees risk.

Economic indicators

The economy can tell us a lot about geopolitical risk:

| Indicator | What it means for risk |

|---|---|

| Investment levels | Low investment? Risk might be high |

| Stock prices | Falling prices? Could be higher risk |

| Employment rates | Low employment? Might mean higher risk |

| Disaster probability | Higher chance of disaster? Higher risk |

Oil price change indexes

These track how world events shake up oil prices. The geopolitical oil price risk index (GOPRX) is one example:

- It's on a scale of 0 to 100 (100 = maximum risk)

- It lines up pretty well with the Oil Volatility Index (OVX)

- It doesn't line up much with oil supply

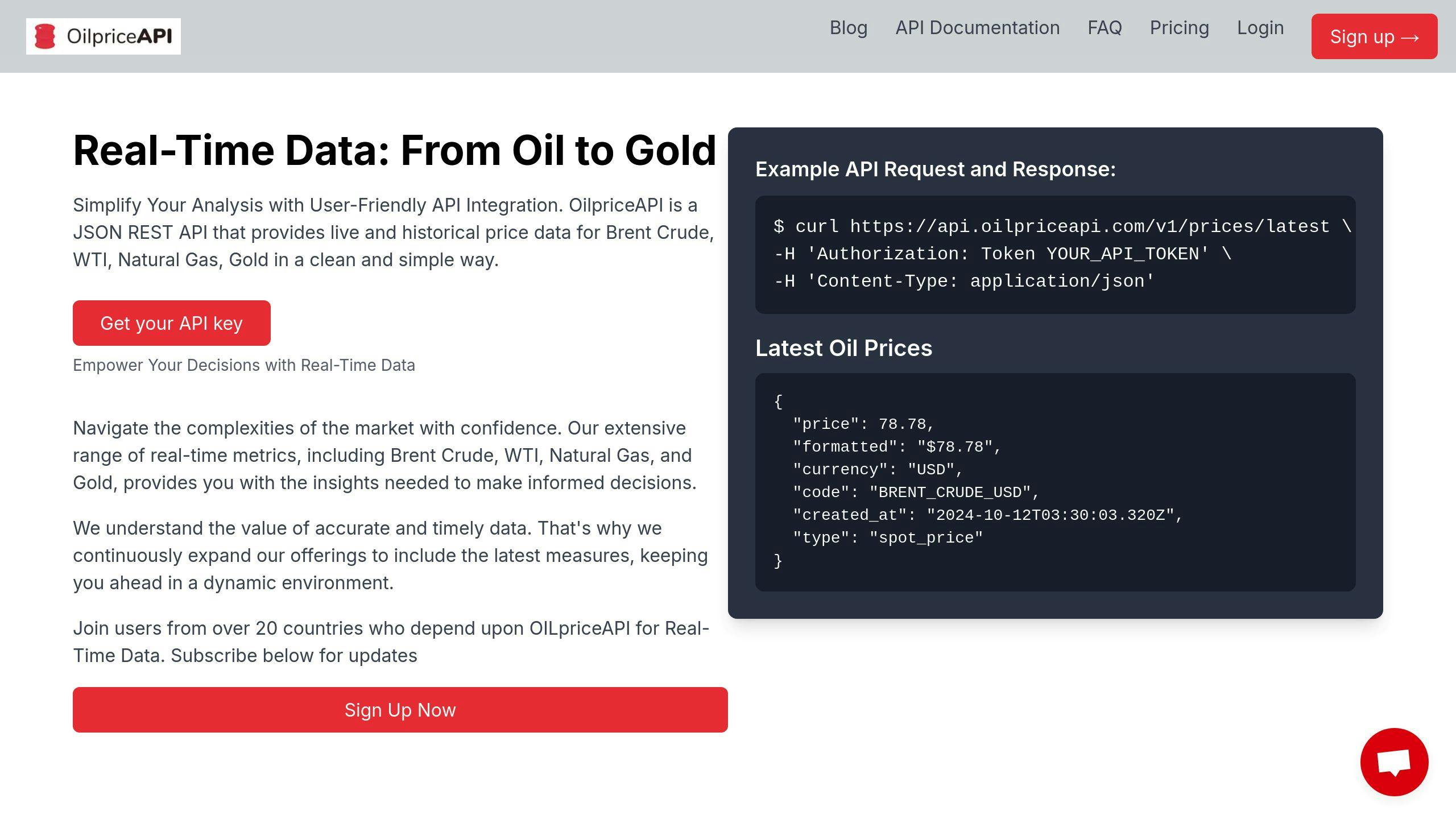

Want to keep tabs on oil prices? Tools like OilpriceAPI can give you real-time data.

Managing oil price changes caused by world events

Geopolitical events can send oil prices on a rollercoaster ride. Here's how businesses and investors can protect themselves:

Spreading out investments

Don't put all your eggs in one basket. Mix it up:

- Different energy sources

- Various regions

- Multiple sectors

If one area takes a hit, you're not totally exposed.

Hedging methods

Lock in prices and limit risk:

| Method | How it works | Example |

|---|---|---|

| Futures contracts | Buy/sell oil at set price later | Refiner buys futures at $80/barrel for 3-month delivery |

| Options | Right to buy/sell at specific price | Airline buys call options at $85/barrel as insurance |

| Forward contracts | Custom deals between two parties | Producer sells 500,000 barrels at $75/barrel in 6 months |

Planning for different scenarios

Think ahead:

1. Best case: Stable prices

Focus on efficiency and market share

2. Worst case: Major price swing

Have emergency cash and know where to cut costs

3. Middle ground: Some volatility

Mix fixed and variable-price contracts

Keeping up with world news

Stay informed. Watch:

- Middle East tensions

- OPEC+ decisions

- Major producers (Russia, US, Saudi Arabia)

- Global economic trends

Set up news alerts for these areas.

Using up-to-date data and analysis tools

Accurate, timely data is key. OilpriceAPI offers:

- Real-time prices for Brent Crude, WTI, and Natural Gas

- Historical trends

- API for custom analysis

With these strategies, you can navigate the choppy waters of oil price swings.

Conclusion

Geopolitical risks shake up oil prices. Here's the rundown:

- Wars, unrest, and trade spats rattle oil markets

- These events mess with supply, demand, and market speculation

- Remember the 1973 Arab Oil Embargo? That's politics and oil prices in action

What's on the horizon?

| Challenge | Potential Impact |

|---|---|

| Israel-Hamas conflict | Oil could hit $150/barrel in 2024 |

| OPEC+ supply cuts | Possible market deficit soon |

| Global demand growth | 1.1 million b/d increase expected in 2024 |

How to handle these risks?

- Mix up your energy investments

- Use hedging tools

- Plan for different price scenarios

- Keep an eye on world news and market trends

Daniel Yergin, energy guru, says:

"Safety and certainty in oil... lie in variety and variety alone."

Churchill's advice still holds. Diversify and stay flexible to ride out oil market storms.

In the oil game? Real-time data is key. Tools like OilpriceAPI can help you stay on top of prices and trends.

FAQs

How does geopolitics affect oil prices?

Geopolitics can shake up oil prices in two ways:

- It can slow down economies, cutting oil demand and prices.

- It can threaten oil supplies, potentially driving prices up.

But here's the thing: there's no clear pattern. Look at these examples:

- After 9/11: Brent prices jumped 5%, then dropped 25% in two weeks.

- 2022 Russia-Ukraine invasion: Brent prices shot up 30% in two weeks, then went back to normal in two months.

"Geopolitical shocks can impact oil prices through lower economic activity or higher risks to commodity supply." - Massimo Ferrari Minesso, Author

What does this mean for you?

- Big events don't always equal big price swings.

- Oil prices often stay low for months after major events.

- Each shock is unique - you need to understand it to get its impact.

Want to stay on top of oil prices? Keep an eye on:

- What OPEC's doing

- Any drama in oil-producing areas

- How the global economy's doing