How Central Bank Policies Impact Gold Prices

How Central Bank Policies Impact Gold Prices

Central bank policies directly influence gold prices. Here's what you need to know:

- Interest rates: Higher rates often lower gold prices

- Economic uncertainty: Boosts gold as a safe haven

- Dollar strength: Weaker dollar typically increases gold prices

- Central bank buying: Drives up demand and prices

Key facts:

- 2024: Gold hit record $2,450/oz (23% increase since January)

- Central banks bought 1,082 tons of gold in 2022, 1,037 tons in 2023

- US Federal Reserve rate at 5.5% (20-year high) pressures gold prices

Expert predictions:

- 2024 price range: $2,421 - $2,651

- Long-term potential: Up to $2,810.76

| Central Bank Action | Gold Price Impact |

|---|---|

| Cut interest rates | Usually increases |

| Raise interest rates | Often decreases |

| Increase money supply | Tends to rise |

| Buy gold reserves | Pushes prices up |

Watch central bank decisions closely - they're key drivers of gold market trends.

Related video from YouTube

OilpriceAPI

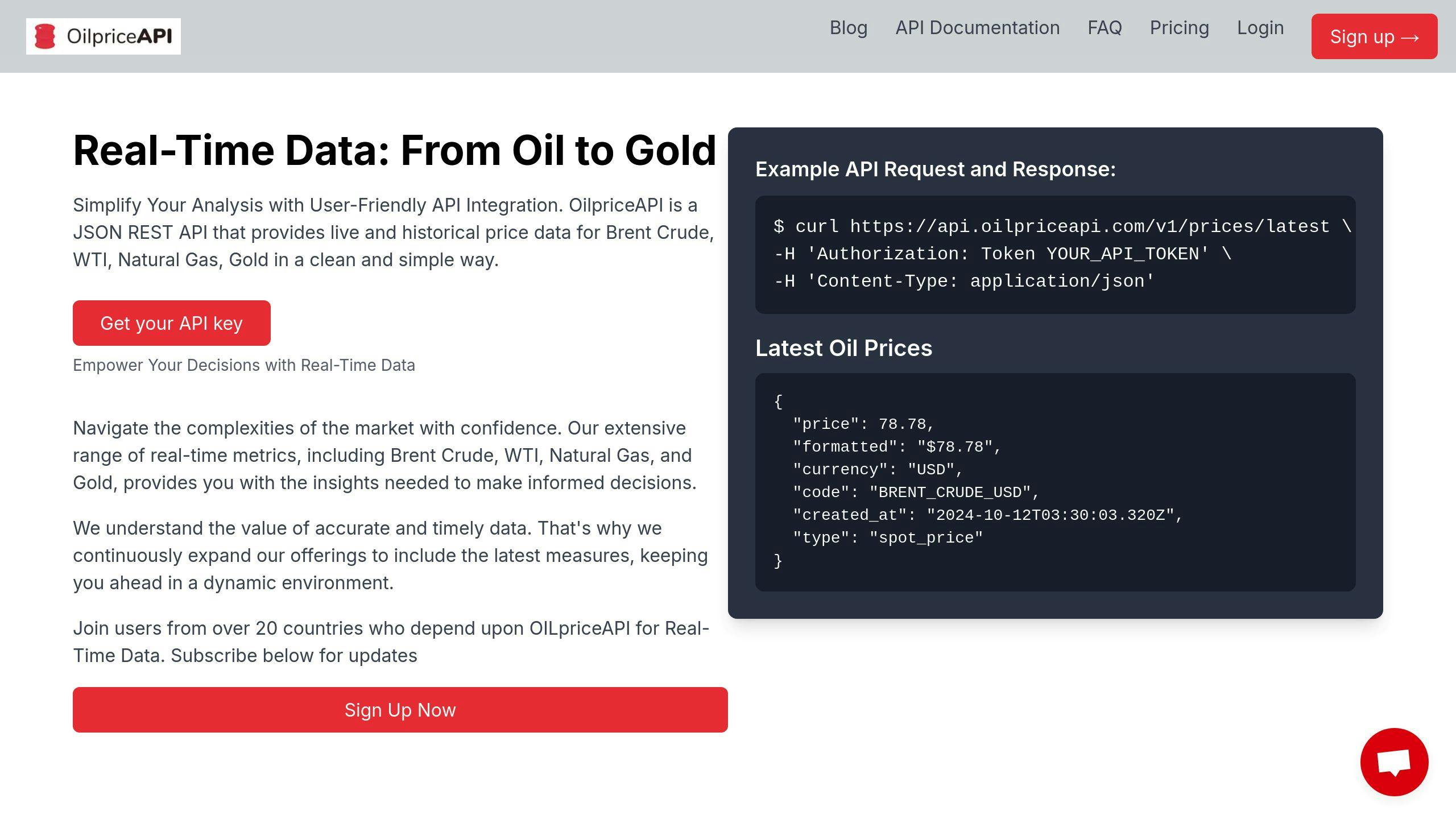

OilpriceAPI is a go-to tool for tracking gold prices and central bank policies. It's packed with features that help investors and analysts make smart choices.

Real-time and Historical Data

This API doesn't mess around. It gives you:

- Up-to-the-minute gold prices

- Historical data for spotting trends

This combo is perfect for seeing how the market reacts when the Fed or other big banks make moves.

Easy Integration

OilpriceAPI just got a makeover. Now it's even easier to use:

- 25% more API tiers for testing

- Gold and natural gas prices for US/UK markets

- Built-in currency conversions

The coolest part? You can now pull data straight into Google Sheets. No coding needed.

Try Before You Buy

OilpriceAPI offers a free API key. Test it out and see if it's right for you.

They've also got a nifty chart comparing gold and oil prices since 1946. It's a goldmine (pun intended) for spotting long-term trends.

"Gold and oil prices are going their separate ways. Gold's up, while oil's feeling the pressure", says a recent market report.

This shift shows why tools like OilpriceAPI are crucial. They help you keep up with the twists and turns in the market, especially when central banks are shaking things up.

sbb-itb-a92d0a3

Good and Bad Points

Central banks play a big role in gold prices. Let's break down the pros and cons:

| Upsides | Downsides |

|---|---|

| Central bank demand can boost gold prices | Banks often buy high, sell low - not great for investors |

| Gold hedges against economic uncertainty | Too much gold buying can slow economic growth |

| Bank purchases show faith in gold as a reserve | Bank actions can cause short-term market swings |

| Gold adds stability to financial holdings | Overreliance on gold limits economic flexibility |

Since 2009, central banks have been net gold buyers. In 2021, they snatched up 362.6 tons - a 37.5% jump from 2020. This steady demand has helped push gold prices up.

The USA is the gold-buying champ. Its reserves shot up from $72 billion in 2000 to $472 billion in 2021. That's a massive increase during the global financial crisis.

But here's the catch: central banks aren't always great at timing. They often sell low and buy high. Not the best example for investors to follow.

"Central Banks are mean reversal agents." - Author Unknown

This quote hints at how central banks often swim against the market current. It can be good or bad for gold prices.

China and Russia have also been on a gold-buying spree. China grabbed $114 billion worth over 20 years, while Russia added $131 billion. They're aiming to beef up their currencies and protect against sanctions.

But too much gold focus has its downsides. It can tie a country's hands when it comes to growing the money supply or reacting to economic shifts. Take the 2008 crisis - the Federal Reserve's actions helped avoid a worse outcome. That wouldn't have been possible with a strict gold standard.

Wrap-up

Central banks and gold prices are tightly connected. Here's what you need to know:

Central banks have been gobbling up gold since 2010. In 2022, they bought a whopping 1,082 tons. 2023 wasn't far behind with 1,037 tons. This buying frenzy has helped push gold prices to new heights.

When the economy gets shaky, everyone runs to gold. In 2023, gold prices smashed records, topping $2,400 per ounce.

The Fed's interest rate decisions are a big deal for gold prices. Low rates? Gold shines. High rates? Not so much.

| Fed Move | Gold's Reaction |

|---|---|

| Cut rates | Price usually jumps |

| Raise rates | Price often dips |

| Print money | Price tends to climb |

Gold's role has changed. It's not a constant inflation shield anymore. Now, it works best when inflation is through the roof.

China and Poland have been on a gold-buying spree. In 2023, China added 225 tons to its stash, while Poland snagged 130 tons.

For investors, watching central banks is crucial. As Alan Greenspan, former Fed chair, put it:

"Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it."

Keep an eye on those central bank moves. They might just predict gold's next big swing.

FAQs

What's the deal with gold and real interest rates?

Gold and real interest rates? They're like oil and water. When real rates drop, gold prices usually climb. Here's why:

- Low rates make gold look good (even though it doesn't pay you)

- They often mean high inflation or easy money policies

Think back to the late '70s. The U.S. economy was a mess, inflation was through the roof, and guess what? Gold prices shot up 721% from 1976 to 1980. Wild, right?

Fast forward to 2022. The Russia-Ukraine conflict kicked off, and boom - gold jumped 6% as investors ran for cover.

| Real Rates | Gold Prices |

|---|---|

| Low | Up |

| High | Down |

Central banks get it. The Dutch central bank put it bluntly:

"A bar of gold always keeps its value. Crisis or not. That gives a safe feeling."

No wonder central banks are loading up on gold. About 25% plan to keep buying in the next year.