RSI Trading Guide: Gold Analysis

RSI Trading Guide: Gold Analysis

RSI (Relative Strength Index) is a momentum indicator that helps identify potential buying or selling points in gold trading. It measures price movements on a scale of 0 to 100. Here's how it works:

- RSI above 70: Gold may be overbought; consider selling.

- RSI below 30: Gold may be oversold; consider buying.

- 30-70 range: Neutral zone; look for other signals.

Key RSI Strategies:

- Divergence: Watch for mismatches between price action and RSI to spot trend reversals.

- Bullish Divergence: Price makes lower lows, RSI makes higher lows (buy signal).

- Bearish Divergence: Price makes higher highs, RSI makes lower highs (sell signal).

- Combine RSI with Other Tools: Use moving averages, candlestick patterns, and volume data for stronger signals.

- Timeframe Analysis: Start with daily charts for trends, then zoom into hourly charts for entries.

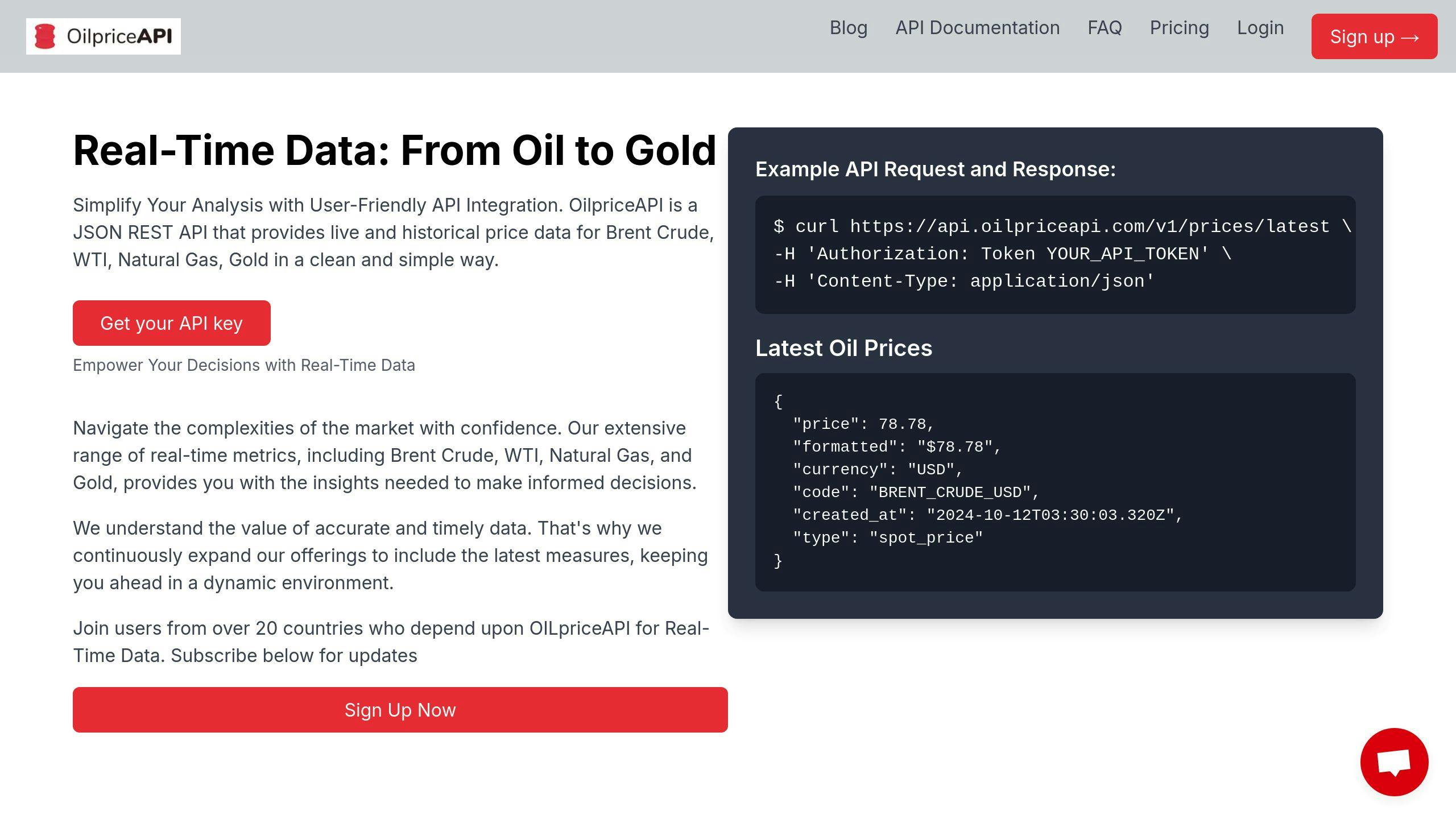

Pro Tip: Use real-time gold price data (e.g., via APIs) for accurate RSI calculations and timely trade decisions.

Related video from YouTube

How to Read RSI Signals

The RSI (Relative Strength Index) moves between 0 and 100, giving you clear signals about gold market conditions and price movements. Let's break down how to read these signals to make better trading decisions.

Identifying Overbought and Oversold Levels

When RSI goes above 70, it tells you gold might be getting too expensive - time to think about selling. When it drops below 30, gold could be too cheap - a buying opportunity might be coming up.

Here's what different RSI levels mean for your trading:

| RSI Signal | Market Condition | Trading Implication |

|---|---|---|

| Above 70 | Overbought | Time to sell or lock in profits |

| Below 30 | Oversold | Watch for buying chances |

| Between 30-70 | Neutral | Keep an eye on other signals |

But here's the thing: during strong market trends, gold prices can stay in overbought or oversold territory longer than you'd expect. That's why smart traders don't rely on these levels alone.

Recognizing RSI Divergence

Think of RSI divergence as your early warning system for possible trend changes. It's like when the weather looks fine, but your barometer shows a storm coming.

Here's what to watch for:

- Bullish divergence: Gold prices are making lower lows, but RSI shows higher lows. This hints at hidden buying pressure building up.

- Bearish divergence: Gold hits new highs, but RSI makes lower highs. This suggests the upward momentum might be running out of steam.

To spot these patterns as they form (not after the fact), you'll need fresh, accurate data. Tools like OilpriceAPI help by feeding you real-time gold prices for precise RSI calculations.

Using RSI in Gold Trading Plans

Smart gold traders know that RSI works better when it's part of a bigger trading plan. Here's how to get more from RSI in your gold trades.

Combining RSI with Other Tools

Want stronger trading signals? Look for moments when price crosses a moving average while RSI drops below 30 (oversold). This double-confirmation approach beats using RSI by itself.

Here's a no-nonsense guide to pairing RSI with other tools:

| Tool | How to Use with RSI |

|---|---|

| Moving Averages | Watch for price/MA crossovers during RSI signals |

| Price Action | Check RSI readings at key support/resistance zones |

| Volume | Look for volume spikes that back up RSI signals |

Analyzing RSI Across Timeframes

Think of timeframe analysis like looking at a map - start with the big picture, then zoom in for details. Begin with daily charts to spot the main trend, then switch to shorter timeframes to nail down your entry points.

Here's what makes a strong setup: Say your daily RSI hits 28 (oversold), and your hourly RSI shows 25 and starts turning up. That's the kind of alignment that points to better buying chances. By checking multiple timeframes, you'll cut through market noise and spot the trades worth taking.

"By combining RSI with other indicators and analyzing it across different timeframes, traders can enhance their ability to spot potential trading signals and enter trades with confidence."

Pro tip: You'll need solid data for this to work. Services like OilpriceAPI give you the real-time gold price data that makes precise RSI analysis possible.

sbb-itb-a92d0a3

RSI Strategies for Gold Trading

Want to make smarter trades in gold? Let's look at two RSI approaches that can help you spot better trading opportunities.

Using RSI Divergence to Spot Reversals

Think of RSI divergence as your early warning system. It's like when your car's engine sounds different before a problem becomes obvious - the RSI can tell you something's changing in the market before the price shows it.

Here's what to watch for: When gold hits a new low but the RSI shows a higher low, that's bullish divergence. The opposite happens with bearish divergence - gold reaches new highs while RSI forms lower highs, hinting that the upward push is running out of steam.

| Divergence Type | Price Action | RSI Pattern | What It Means |

|---|---|---|---|

| Bullish | New Low | Higher Low | Potential upward reversal |

| Bearish | New High | Lower High | Possible downward reversal |

| Hidden Bullish | Higher Low | Lower Low | Trend continuation up |

| Hidden Bearish | Lower High | Higher High | Trend continuation down |

Pairing RSI with Candlestick Patterns

Want stronger trading signals? Combine RSI readings with candlestick patterns. For example, when RSI dips below 30 (oversold) and you see a bullish engulfing pattern, you've got a much stronger buy signal than using either tool by itself.

"The RSI indicator is a widely used tool in technical analysis and can provide valuable insights into gold and forex trading." - TradingView, 2023.

Here's what works best: Look for RSI crossing above 30 paired with a hammer candlestick, RSI dropping below 70 next to a shooting star, or doji candles forming at RSI extreme levels.

Quick tip: Don't rely on old data - use real-time tools like OilpriceAPI to catch these patterns as they happen. After all, timing is everything in trading.

Using Real-Time Gold Data with OilpriceAPI

Want to trade gold using RSI? You'll need rock-solid price data - and that's exactly what OilpriceAPI delivers through its gold price API.

Think of OilpriceAPI as your direct line to the gold market. It gives you both real-time prices and historical data, so you can make smart RSI-based trading moves.

Here's what makes OilpriceAPI stand out for RSI traders:

| Feature | What It Means For You |

|---|---|

| Real-Time Updates | Get price data the moment it changes - perfect for RSI math |

| Historical Data | Test your RSI strategy before risking real money |

| Clean Data Feeds | No glitches or gaps in your price info |

| Easy Setup | Spend time trading, not fixing tech issues |

When you're trading with RSI, timing is everything. OilpriceAPI helps you:

- Spot overbought and oversold conditions right as they happen

- Calculate RSI values using fresh, accurate data

- Catch price divergences before other traders

"The API ensures that traders have access to accurate and up-to-date gold price data, which is critical for making precise RSI calculations and timely trading decisions."

Summary of RSI Trading for Gold

Let's break down how to use RSI effectively when trading gold.

Trading gold with RSI isn't just about watching numbers - it's about reading the market's story. Smart traders don't rely on RSI alone. Instead, they mix it with other technical tools to spot the best trades and avoid false signals. Think of it like a detective using multiple pieces of evidence rather than just one clue.

Here's what works in real trading:

| Trading Aspect | Implementation Strategy | Key Benefit |

|---|---|---|

| Signal Confirmation | Mix RSI with candlestick patterns | Fewer fake-outs |

| Trend Analysis | Check multiple timeframes | Better trade entries |

| Risk Management | Watch RSI divergence with price action | Early reversal warnings |

RSI divergence is like an early warning system for price reversals - it's one of your best tools for gold trading. When markets get extra jumpy, you might want to tweak those standard RSI settings. Instead of using 70/30 levels, bump them up to 75/25. This small change can help you dodge some false signals during wild market swings.

Tools like OilpriceAPI make it easier to crunch RSI numbers and jump on opportunities quickly. Here's what your trading plan should include:

- Double-check signals with other indicators

- Adjust your strategy when markets get wild

- Set clear stop-losses (no exceptions!)

- Keep testing what works and what doesn't

The best traders don't just look at RSI - they watch for backup signals from other technical patterns and never skip their risk management rules. It's this no-shortcuts approach that helps them stay consistent, whether markets are smooth or choppy.

FAQs

What is an example of a RSI divergence?

Let's look at how RSI divergence works in gold trading. The most common example? When gold's price goes up, but the RSI goes down - that's bearish divergence in action.

Picture this: Gold's price hits new highs, but the RSI shows lower highs. It's like a car speeding up but running out of gas - something's not quite right. This mismatch often hints at a possible trend change.

Here's a quick breakdown:

| Divergence Type | Price Action | RSI Movement | Trading Signal |

|---|---|---|---|

| Bearish | New price high | Lower RSI high | Potential downward reversal |

| Bullish | New price low | Higher RSI low | Potential upward reversal |

Let's make it real: Say gold climbs from $1,900 to $1,950, but during this rise, the RSI drops from 75 to 65. That's a red flag - the upward push is getting weaker, even though prices are still climbing.

"RSI divergence occurs when the price and the RSI move in opposite directions, signaling that the current trend may be losing momentum and could reverse soon."

Here's what smart traders do: Before acting on an RSI divergence signal, they check:

- Market conditions and trends

- Key support and resistance points

- Trading volume patterns

Think of these extra checks as your safety net - they help you avoid false signals and make better trading decisions.