Top 10 Commodity Price Apps 2024

Top 10 Commodity Price Apps 2024

Stay ahead in the fast-moving commodity markets with these essential apps:

- Bloomberg: Pro-level data, costly but comprehensive

- Reuters: Global news and market insights

- Trading Economics: Vast economic indicators and forecasts

- CME Group: Futures trading powerhouse

- Investopedia: Learn while you track prices

- Vesper: AI-powered forecasts for agri-commodities

- USDA ERS: Go-to for agricultural data

- World Bank CPD: Global price trends and forecasts

- S&P Global Platts: Energy market specialist

- OPEC MOMR: Deep dive into oil markets

Quick Comparison:

| App | Best For | Key Feature | Cost |

|---|---|---|---|

| Bloomberg | Pros | Real-time data | $$$$ |

| Reuters | News hounds | Global coverage | Free/$ |

| Trading Economics | Data lovers | Economic indicators | Free/$ |

| CME Group | Futures traders | Largest derivatives market | Free |

| Investopedia | Beginners | Educational content | Free |

| Vesper | Ag traders | AI forecasts | $ |

| USDA ERS | Farmers | Crop data | Free |

| World Bank CPD | Global view | Long-term trends | Free |

| S&P Global Platts | Energy focus | Price assessments | $$$ |

| OPEC MOMR | Oil specialists | Detailed oil reports | Free/$ |

Choose based on your needs: Bloomberg for pros, Investopedia for newbies, OPEC MOMR for oil buffs. Remember, commodity trading is risky - educate yourself and start small.

Bloomberg

Bloomberg's commodity price app is a top pick for traders and investors in 2024. It's like having a Bloomberg Terminal in your pocket, packed with features for tracking commodity prices and market trends.

What's cool about the Bloomberg app?

- Real-time commodity price data

- Custom alerts for prices and news

- Bloomberg's financial news and analysis

- Works with Bloomberg Anywhere® for smooth workflow

The app gives you a bird's-eye view of commodity markets. You can check out forward curves that update all day, showing the latest market prices. This is gold for traders making decisions based on future price predictions.

The news feed is another standout. You can set up custom feeds with instant audio and visual alerts. As one user put it:

"Bloomberg's custom news alerts are a game-changer. No more juggling multiple sources – everything I need is right there."

But here's the catch: it's pricey. A Bloomberg terminal subscription costs $27,660 a year. That's not pocket change for most folks. But for pro traders and big institutions, the depth and quality of data can justify the cost.

Here's a quick rundown:

| Pros | Cons |

|---|---|

| Loads of market data | Expensive |

| Real-time updates | Tricky for newbies |

| Custom alerts | Need a Bloomberg subscription |

| Works with Bloomberg Terminal | Can be info overload |

If you're a commodity trader who needs the latest and most comprehensive data, Bloomberg's app is tough to beat. It's a powerhouse combo of real-time pricing, news alerts, and analysis tools for the fast-paced world of commodity trading.

2. Reuters

Reuters' LSEG Eikon platform is a top commodity price app for 2024. It's a Bloomberg alternative that doesn't skimp on features.

What's in the box?

- Real-time prices for energy, metals, agriculture, shipping, and carbon

- Reuters news feed

- Custom alerts

- Historical data and analysis tools

The Dealerweb integration is a nice touch. It adds Treasury market coverage, making Eikon more useful for traders who look beyond commodities.

For energy and commodities traders, Eikon has some tricks up its sleeve:

| Feature | What it does |

|---|---|

| City Execution | Run futures and options orders |

| Spread data | See and crunch spread data in-app |

| Integrated trading | Trade without leaving Eikon |

Leigh Henson from Thomson Reuters says:

"The addition of City Execution onto Thomson Reuters Eikon exemplifies the benefits of an open platform."

Farmers get a special treat: Data Share. This app lets them swap crop data for market insights. Jeff Haas explains:

"The goal of Data Share is to create well-informed markets with greater transparency."

Now, let's talk money:

| Service | Yearly Cost |

|---|---|

| LSEG Eikon (full) | $22,000 |

| LSEG Eikon (lite) | $3,600 |

| Bloomberg Terminal | From $30,000 |

Eikon's not cheap, but it's easier on the wallet than Bloomberg.

Heads up: By 2025, Eikon users will move to the new Workspace platform, built with Microsoft. Expect more updates and improvements.

Bottom line: If you need solid commodity data without breaking the bank, LSEG Eikon is worth a look. It's packed with features for energy and ag markets, making it a strong pick for 2024.

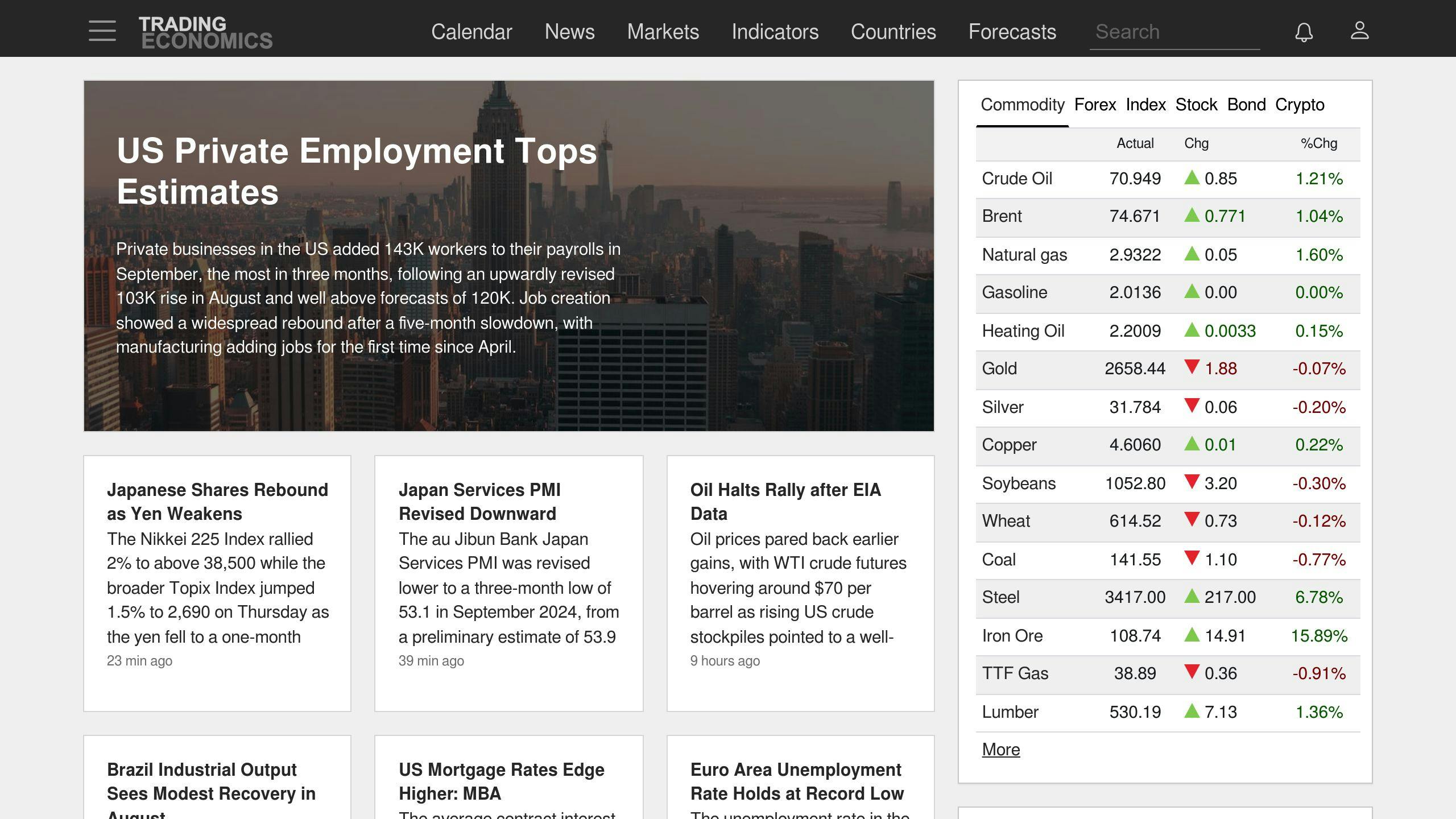

3. Trading Economics

Trading Economics isn't just another commodity price tracker. It's a data powerhouse that gives you the whole economic picture.

Here's the deal:

- 20 million economic indicators in real-time

- Data from 196 countries

- Up-to-date commodity prices (as of October 3, 2024)

The commodity section? It's packed:

| Feature | What You Get |

|---|---|

| Live quotes | Bid/ask prices, last traded values |

| Historical data | Time series charts for analysis |

| Forecasts | Price predictions |

| News feed | Latest market updates |

Traders, pay attention to the CRB Commodity Index. It's up 13.29% (40.07 points) since January 2024. This benchmark helps you spot market trends.

The free version gives you:

- Economic calendar

- Exchange rates

- Stock market indexes

- Government bond yields

But here's where Trading Economics shines: alerts. Set up notifications for:

- Price targets

- Price changes

- Record highs/lows

You'll stay in the loop without being glued to your screen.

With 380 million page views from 200+ countries, it's a global favorite. Plus, it uses official sources and checks for accuracy.

Tech requirements:

- iOS 13.0+ (iPhone/iPad)

- macOS 11.0+ (Mac with Apple M1 chip)

For commodity traders in 2024, Trading Economics hits the sweet spot: deep data, easy to use.

4. CME Group

CME Group's mobile app isn't just a price tracker. It's a full trading platform in your pocket.

What's inside:

- Real-time futures and options data

- Access to the world's largest derivatives marketplace

- Trading tools for risk management

The app covers:

| Commodity | Examples |

|---|---|

| Agricultural | Corn, Wheat, Soybeans |

| Energy | Crude Oil, Natural Gas |

| Metals | Gold, Silver, Copper |

CME Group's strength? Volume. In 2024, they're handling $10 trillion daily across all products. That's 95% of U.S. exchange volume.

For traders, this means deep liquidity, tight spreads, and better price discovery.

Trade 24/7 on iPhone, Android, tablets, and Apple Watch.

The CME FedWatch Tool is a standout. It shows real-time probabilities of Fed rate changes. Crucial for commodity traders.

Not just for pros. CME Group offers educational resources, including webinars from top traders.

Tech-wise, they use WebSocket API for real-time data. Faster updates, less lag.

If you're serious about commodity trading in 2024, CME Group's app is a must-have.

5. Investopedia

Investopedia's commodity price app is a goldmine for investors looking to dive into commodities. It's not just about tracking prices - it's your personal commodity trading tutor.

Here's what you get:

- Real-time commodity price updates

- A crash course in commodity trading

- Tools to dissect the market

The app covers all the bases:

| Commodity Type | What's Included |

|---|---|

| Metals | Gold, Silver, Copper |

| Energy | Crude Oil, Natural Gas |

| Agriculture | Corn, Wheat, Soybeans |

| Livestock | Cattle, Hogs |

Investopedia shines in breaking down complex ideas. Ever wondered what a futures contract really is? They've got you covered.

For the newbies, there's a toolkit to help you read the market:

- Spot trends

- Gauge market strength

- Track momentum

- Analyze volume

These tools help you make smarter trades.

Here's a cool tidbit: commodities often zig when stocks zag. That's why they're great for hedging when the market gets rocky.

For the hands-on folks, the app dives into:

- The ins and outs of futures contracts

- How to own physical commodities

- Commodity-related securities

But here's the kicker: Investopedia doesn't just show you how to trade. It teaches you how to trade smart. They hammer home the importance of reading the fine print and picking the right broker for futures trading.

Bottom line? While you can't trade directly through the app, it's your go-to guide for all things commodities in 2024.

6. Vesper

Vesper is a standout commodity price app for 2024, focusing on dairy, sugar, oils, and fats. This Amsterdam-based platform delivers real-time data, insights, and forecasts for the agri-commodity sector.

Key features:

- Spot price tracking

- Historical data for trend analysis

- AI-powered forecasting

- Customizable alerts

- User-friendly interface

Vesper's strength? Actionable intelligence. Set alerts for specific price thresholds or market conditions to make timely decisions.

Users love it:

"Vesper helps me evaluate global price indexes, mitigating potential risks for years ahead." - Robert Hazenberg, Procurement Director Direct Materials, MeadJohnson

"I use Vesper for analytics and business intelligence. It's crucial during complex retail chain negotiations." - Timm Brocks, CEO and Co-Founder, Buensol

The mobile app offers:

- Sleek design

- Interactive graphs

- On-the-go access

Vesper covers 17 agri-commodity categories with over 4,000 price series and forecasts.

Extra features:

- WhatsApp groups for updates

- Direct contact with customer success managers

- Webinars with analysts

- Industry expert podcast (50,000+ downloads)

Launched in October 2019, Vesper has raised €5 million in seed funding and is trusted by Nestlé, Fonterra, and Unilever.

In a field where timing is everything, Vesper's mix of real-time data, AI forecasts, and user-friendly design makes it a top choice for 2024.

sbb-itb-a92d0a3

7. USDA Economic Research Service

The USDA Economic Research Service (ERS) is a go-to resource for tracking commodity prices in 2024. Their digital tools give ag pros key market info on demand.

The USDA Market News Mobile Application is their standout offering. Launched in 2022, it's become a must-have for producers and supply chain folks. Here's why:

- Covers nearly 1,500 market reports

- Easy to search by location, state, or commodity

- Sends real-time notifications for new reports

Jenny Lester Moffitt, Under Secretary for Marketing and Regulatory Programs, says:

"The Market News app helps create a more level playing field for small and medium producers by delivering critical market information to them where they are, when they need it."

The app's been a hit:

| Metric | Value |

|---|---|

| Downloads | 14,500+ |

| Unique Report Views | 320,000+ |

| Average Daily Views | 1,400 |

ERS also offers the Charts of Note Mobile App. It gives you:

- 24/7 access to thousands of ERS charts

- Easy topic filters

- Options to save favorites and share

These apps work alongside other ERS resources, like the Food Price Outlook, which forecasts changes in food-related CPI and PPI.

8. World Bank Commodities Price Data

Want to track global commodity prices in 2024? The World Bank's Commodities Price Data app is your go-to tool.

Here's what you get:

- Daily updates on 234,772 observations

- Monthly price refreshes

- Biannual forecasts

- Long-term price trends

The app covers a ton of commodities. Here's a taste:

| Commodity | Price Unit |

|---|---|

| Aluminum | $/mt |

| Bananas | $/kg |

| Coffee (Arabica) | $/kg |

| Copper | $/mt |

| Cotton | $/kg |

In April 2024, the World Bank's Commodity Market Outlook (CMO) dropped some news: global commodity prices are leveling out after a big dip. Why does this matter? It's key for understanding market trends and how they affect inflation and central bank decisions.

The app also includes the Manufacture Unit Value Index (MUV). It's updated twice a year and gives you a snapshot of manufacturing trends.

Heads up: a new interactive dashboard is in the works. It'll make the data even easier to use and understand.

Bottom line: if you're in the commodity market game, this app is a must-have for reliable price data and forecasts.

9. S&P Global Platts

S&P Global Platts' Dimensions Pro app is a game-changer for commodity market pros in 2024. It's packed with data and insights to help you track and analyze commodity prices on the go.

Here's what you get:

- Real-time updates on 15,000+ daily price assessments

- Breaking news alerts

- Custom notifications for price changes

- Advanced charting tools

- Offline access to critical info

The app covers energy, metals, agriculture, and petrochemicals. It syncs with Platts Connect, so you can switch between desktop and mobile without missing a beat.

"Platts Connect reimagines how we deliver world-leading content to unlock more value for our customers." - Saugata Saha, President, S&P Global Commodity Insights

You can personalize your workspace with custom widgets and report libraries. Apple users get extra perks like Apple Watch compatibility and home screen widgets.

While the app is free to download, you'll need a subscription to S&P Global Commodity Insights. For commodity pros, it's an investment that can lead to smarter, faster decisions in a fast-paced market.

10. OPEC Monthly Oil Market Report

The OPEC Monthly Oil Market Report (MOMR) app is a game-changer for oil industry pros in 2024. It's packed with global oil market info, from supply and demand to price forecasts.

Here's what you get:

- Real-time oil market updates

- Interactive price trend charts

- 25+ years of historical data

- Deep dives into world oil demand and supply

- Breakdown of oil market trend drivers

The app's slick design makes data navigation a breeze. You'll find quick info on:

- OECD oil stocks

- Non-OPEC supply

- OPEC natural gas liquids

And here's a cool feature: Excel exports. Since February 2019, you can download key tables in Excel. Talk about a time-saver for data crunching!

Who needs this app? Oil traders, energy analysts, policy makers, and researchers, to name a few.

The app's free to download, but you'll need a subscription for the full report. Worth it? If you're in oil and gas, absolutely. It's your ticket to smarter decisions in a rollercoaster market.

"We're always looking to make our analysis more user-friendly", says an OPEC rep.

Need help? OPEC's got your back with a dedicated email: [email protected].

Bottom line: In the fast-paced world of oil trading, the OPEC MOMR app is your secret weapon for staying ahead of market trends.

App Comparison

Let's break down the top 10 commodity price apps for 2024:

| App Name | Best For | Key Features | Pricing |

|---|---|---|---|

| Bloomberg | Pro traders | Real-time data, news, analytics | Subscription |

| Reuters | News junkies | Global news, market data | Free + premium |

| Trading Economics | Data nerds | Live quotes, forecasts, charts | Free + paid |

| CME Group | Futures traders | Futures and options data | Free |

| Investopedia | Newbies | Educational content, market data | Free |

| Vesper | Customizers | Personalized watchlists, alerts | Free + purchases |

| USDA ERS | Ag focus | Crop and livestock data | Free |

| World Bank CPD | Global view | Long-term price trends | Free |

| S&P Global Platts | Energy buffs | Specialized energy data | Subscription |

| OPEC MOMR | Oil specialists | Detailed oil market reports | Free app, paid report |

Standout features? Trading Economics gives you live bid/ask quotes and forecasts. OPEC MOMR lets you export Excel tables. Vesper's got interactive charts with zoom.

Pricing's all over the map. Vesper's $8.99/year for no ads. TD Ameritrade? $2.25 per futures contract. tastytrade goes as low as $0.25 per contract.

One Vesper user said:

"Performs exceptionally but there's a few basic commodities that need to be added (diesel fuel, etc) to help procurement professionals track markets in real time."

Bottom line: Pick based on your needs. Oil focus? Try OPEC MOMR. Want a bit of everything? Trading Economics or Vesper might be your jam.

Wrap-up

Mobile apps have revolutionized commodity price tracking. Our top 10 list shows there's an app for everyone, from newbies to pros.

Here's what we've learned:

- Apps range from Bloomberg's high-end tools to Investopedia's beginner-friendly platform

- You'll find free options like CME Group and paid services like S&P Global Platts

- Some apps specialize: USDA ERS for agriculture, OPEC MOMR for oil markets

What's next? Expect more AI and machine learning in these apps. Public's AI insights are just the beginning.

But remember, commodity trading isn't risk-free. Sandra Cho, CEO of Pointwealth Capital Management, says:

"Commodities can serve as a hedge during high inflationary times."

Yet, look at these stats:

| Platform | Retail Investor Accounts Losing Money |

|---|---|

| Plus500 | 82% |

| eToro | 51% |

Ouch. That's why education is key.

Want to try? Here's how:

- Use a demo account first (eToro has one)

- Compare fees (Plus500: $0.49 per Micro contract, eToro: spread-based)

- Don't put all your eggs in one basket

As tech reshapes commodity trading, pick your tools wisely and stay informed. It's your best bet in this tricky market.

FAQs

Can you trade commodities online?

Yes, you can trade commodities online. Here's what you need to know:

Commodities are physical assets like crops, metals, and energy sources. To start, open an account with a platform that offers commodity trading.

In the US, the CFTC regulates commodity trading apps. When choosing a platform, look for:

- Real-time market data

- Good analytical tools

- Easy execution

- User-friendly interface

- Fair fees

- Solid customer support

Tips for beginners:

- Use a demo account first

- Start with commodity CFDs

- Pick a regulated broker

- Have a risk management plan