Gold Price vs. Inflation: Analysis 2024

Gold Price vs. Inflation: Analysis 2024

Gold prices have surged 12% in 2024, reaching a record high of $2,409/oz, driven by inflation concerns, geopolitical risks, and central bank purchases. With U.S. core inflation expected to ease to 3.5% this year, gold remains a popular hedge against economic uncertainty. Central banks have already acquired 290 tonnes of gold in Q1 2024, reflecting its continued importance as a store of value.

Key Highlights:

- Gold’s Inflation Hedge Role: Gold performs well when real interest rates are low or negative, but its relationship with inflation is inconsistent and influenced by investor sentiment.

- Central Bank Activity: 290 tonnes of gold purchased in Q1 2024, emphasizing institutional trust in gold.

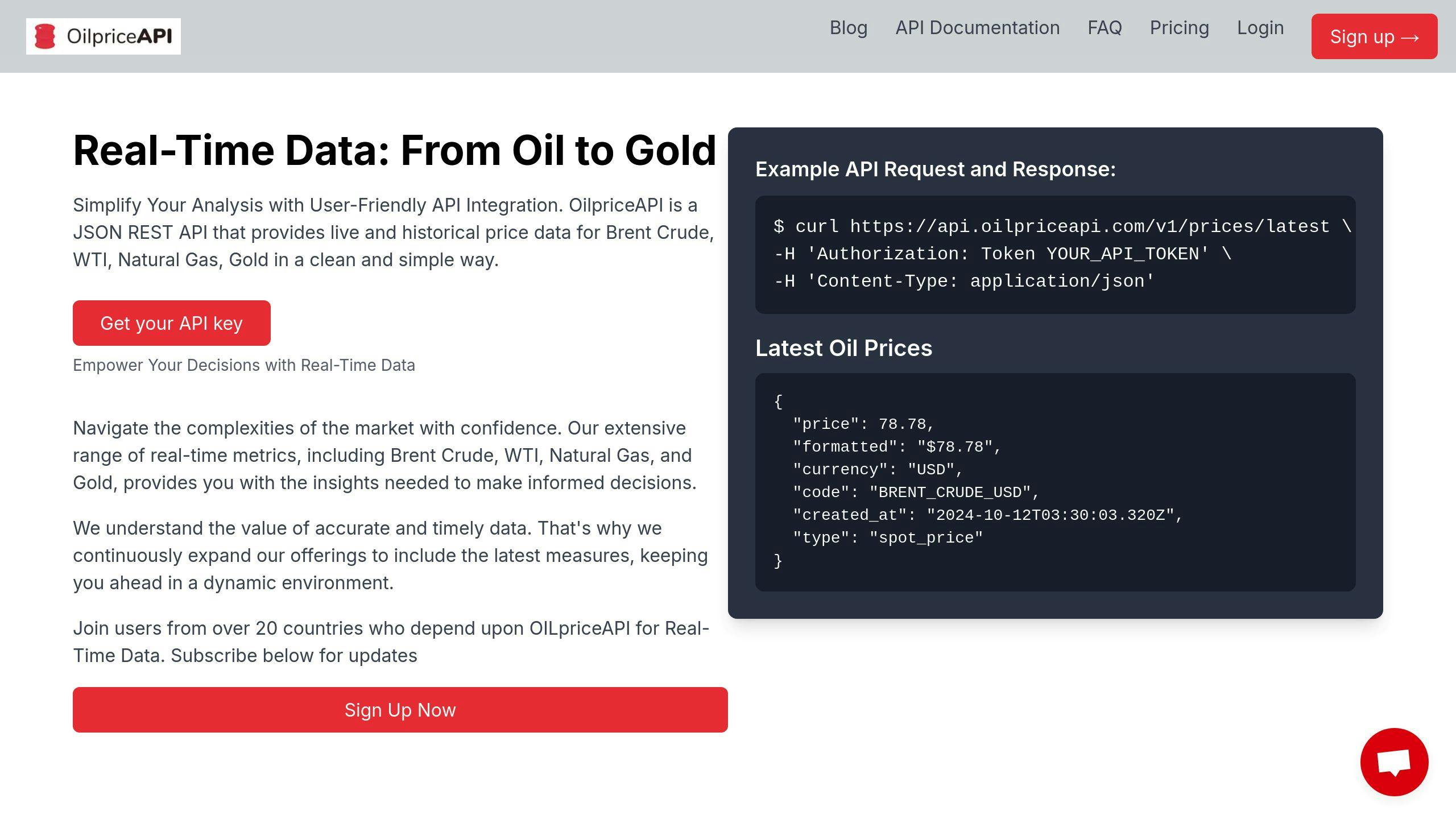

- Technology for Analysis: Tools like OilpriceAPI provide real-time and historical data, enabling investors to track inflation-adjusted gold prices and market trends effectively.

- Future Projections: Analysts forecast gold to average $2,500/oz in Q4 2024 and rise to $2,600/oz in 2025.

Quick Comparison: Advantages vs. Disadvantages of Gold as an Inflation Hedge

| Advantages | Disadvantages |

|---|---|

| Maintains purchasing power in inflation | Volatile prices influenced by various factors |

| Central bank support | Loses value when real interest rates rise |

| Globally recognized and easy to trade | Requires storage and security costs |

| Performs well in economic instability | Doesn’t generate income like dividends |

Gold’s role in portfolios depends on timing and access to reliable tools for monitoring price trends and inflation dynamics. Combining market knowledge with tools like OilpriceAPI can help investors make smarter, data-driven decisions.

1. Gold as a Hedge Against Inflation

Historical Performance

Gold has long been viewed as a safeguard against inflation, and recent trends reinforce this perception. In 2024, gold prices hit a record high of $2,409 per ounce. This spike was fueled by ongoing inflation concerns, geopolitical instability, and a surge in central bank purchases. These factors highlight gold's appeal as a dependable store of value during times of economic strain.

"The relationship between gold prices and inflation has proven to be driven mainly by investor sentiment", says Sean Mason, Investment Advisor Representative at Fresno Financial Advisors.

Understanding how gold performs in inflationary periods requires tools that can track and analyze its inflation-adjusted value.

Inflation Adjustment Tools

Modern technology has made it easier than ever to evaluate gold's performance relative to inflation. Platforms like OilpriceAPI provide real-time and historical gold price data, allowing for detailed inflation-adjusted analysis. These tools have transformed how investors assess gold's value and its role as an inflation hedge.

Investment Utility

Central banks' aggressive gold buying highlights its ongoing importance. In the first quarter of 2024 alone, they acquired 290 tonnes of gold - showing institutional trust in its ability to maintain value during inflationary periods. This trend is particularly relevant as U.S. core inflation is projected to cool to 3.5% in 2024.

Gold's effectiveness as an inflation hedge depends on several factors, with real interest rates being a key driver. Gold tends to perform better when real interest rates are low or negative. However, this relationship is influenced by central bank actions and the global economic climate. To make the most of gold as a hedge, investors should keep a close eye on inflation trends and government fiscal policies.

Using advanced tools like OilpriceAPI can help fine-tune strategies for incorporating gold into an inflation-hedging plan.

2. Using OilpriceAPI for Gold Price Analysis

Data Analysis and Performance Tracking

OilpriceAPI provides tools to build detailed analysis models that link gold price movements with various economic factors. With access to extensive data, analysts can uncover patterns and relationships, such as how gold prices align with inflation rates over time.

"Gold prices have continued to hit fresh highs in 2024 due to a wide range of factors - from escalating geopolitical risks and the interest rate outlook to budget deficit concerns, inflation hedging and central bank buying." - Gregory Shearer, Head of Base and Precious Metals Strategy, J.P. Morgan Research.

Investment Decision Support

For investors, combining inflation data with gold price trends can unlock insights into:

- Historical price behavior during different inflationary periods

- Links between gold performance and key economic metrics

- The effects of monetary policy changes on gold values

- Seasonal patterns and recurring market cycles

With U.S. core inflation expected to ease to 3.5% in 2024, OilpriceAPI’s rich dataset helps investors monitor how gold prices interact with factors like interest rates and policy shifts. Access to real-time data ensures investors can respond quickly to changes in the market.

Related video from YouTube

sbb-itb-a92d0a3

Advantages and Disadvantages

"The direction of travel is still higher over the coming quarters, forecasting an average price of $2,500/oz in the fourth quarter of 2024 and $2,600/oz in 2025." - Gregory Shearer, Head of Base and Precious Metals Strategy, J.P. Morgan.

Gold has long been seen as a safeguard against inflation, but like any investment, it comes with its upsides and downsides. Here's a closer look:

| Advantages | Disadvantages |

|---|---|

| Maintains purchasing power during periods of high inflation | Prices can be volatile, influenced by factors beyond inflation |

| Supported by central banks (1,037 tonnes purchased in 2023) | Typically loses value when real interest rates rise, which can weaken its hedge potential |

| Reflects inflation expectations early on | Requires expensive storage and security measures |

| Globally recognized and easy to trade | Its connection to inflation isn’t always consistent over time |

| Performs well in times of economic instability | Doesn't generate income like dividends or interest-yielding investments |

Gold's effectiveness as an inflation hedge often depends on timing and access to the right tools. Platforms like OilpriceAPI can be incredibly helpful by offering real-time market data and insights. These tools allow investors to track price trends and inflation indicators effectively, helping them make more informed decisions.

To get the most out of gold investments, it's important to keep an eye on broader economic factors, especially real interest rates and central bank policies. Combining market knowledge with reliable data tools can make navigating gold investments much easier and more rewarding.

Conclusion

The connection between gold prices and inflation in 2024 offers a challenging yet intriguing outlook for investors. Understanding this relationship requires careful analysis and reliable tools to track gold's movements and its ties to inflation.

"The direction of travel is still higher over the coming quarters, forecasting an average price of $2,500/oz in the fourth quarter of 2024 and $2,600/oz in 2025." - Gregory Shearer, Head of Base and Precious Metals Strategy, J.P. Morgan.

A rise of 100 basis points in 10-year real yields often results in a 24% decline in inflation-adjusted gold prices. This highlights just how intricate the gold-inflation relationship can be. In today’s unpredictable market, tools like OilpriceAPI are critical for staying informed about gold price trends and inflation dynamics. With markets shifting quickly, having access to real-time data is more important than ever for timely decision-making.

Analyzing inflation-adjusted gold prices plays a key role in building a well-diversified portfolio. It helps investors manage risks while safeguarding their assets against inflation. By leveraging this analysis, investors can make smarter decisions about when and how to allocate gold within their portfolios.

Gold continues to be a reliable asset during times of uncertainty, but success hinges on staying informed and using effective tools to track economic trends and price movements. A solid grasp of inflation-adjusted gold prices can provide a strong foundation for navigating volatile markets and refining investment strategies.

FAQs

How much is gold worth over time compared to inflation?

As of November 19, 2024, gold's inflation-adjusted price stands at $2,635.95. This reflects its long-term growth despite periods of volatility. Historically, gold's inflation-adjusted value has varied greatly, with highs of $3,418.09 and lows of $285.12. Sean Mason from Fresno Financial Advisors explains:

"The relationship between gold prices and inflation has proven to be driven mainly by investor sentiment."

This historical context helps frame how inflation affects gold prices in today's market.

Do gold prices go up during inflation?

Gold prices tend to rise when real interest rates decline, often aligning with inflationary trends. In 2024, this relationship remains evident, with gold gaining strength amid inflation pressures. Broader market factors and institutional investments also play a role in shaping this connection.

What is the inflation-adjusted gold price in 2024?

J.P. Morgan projects gold to average $2,500/oz in Q4 2024, supported by anticipated Fed rate cuts and ongoing inflation. Gregory Shearer, Head of Base and Precious Metals Strategy at J.P. Morgan, states:

"The direction of travel is still higher over the coming quarters, forecasting an average price of $2,500/oz in the fourth quarter of 2024 and $2,600/oz in 2025."

For investors, tools like OilpriceAPI can provide up-to-date data, helping them navigate these shifting market conditions effectively.